Advanced Loan Calculator System: Enhancing Your Loan Management Experience

In the realm of loan management, precision and performance are critical. Envision having a tool available that not just calculates finance details but also provides a detailed breakdown of your financial commitments. Enter the Advanced Car Loan Calculator System, a sophisticated option designed to elevate your car loan management experience to brand-new elevations. This system exceeds the conventional by using personalized repayment options, in-depth insights right into your monetary dedications, and the capacity to contrast and track different financing circumstances. Stay tuned to uncover just how this innovative device can revolutionize the means you approach lending monitoring.

Advantages of Using the System

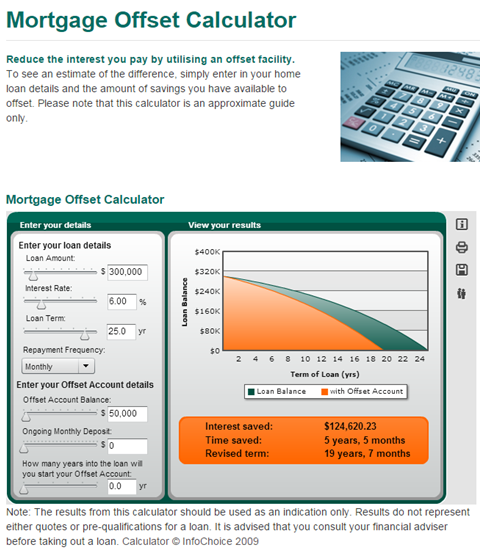

One vital advantage is the system's capability to provide precise and instantaneous calculations for numerous types of financings, including home loans, cars and truck financings, and personal loans. Users can input different variables such as lending quantity, interest rate, and car loan term to rapidly establish monthly settlements and total interest over the life of the funding.

Furthermore, the improved system incorporates interactive functions such as charts and amortization timetables, allowing individuals to picture exactly how their settlements will certainly evolve in time and comprehend the break down of principal and passion. These aesthetic aids improve users' comprehension of complicated economic concepts and empower them to make sound monetary choices. In addition, the system's straightforward interface makes it accessible to people with differing degrees of economic literacy, promoting financial education and empowerment.

Trick Includes Overview

What one-of-a-kind functionalities distinguish the enhanced Car loan Calculator System from standard economic tools? The advanced Funding Calculator System uses a variety of key functions that set it apart in the world of finance administration tools. The system supplies customers with real-time calculations based on personalized specifications, enabling for precise and dynamic estimates of lending terms. This feature allows customers to make enlightened decisions promptly. Second of all, the system incorporates interactive graphs and charts to aesthetically stand for finance amortization timetables, making complex financial information much more obtainable and simpler to translate. Additionally, the system consists of a thorough repayment schedule that describes principal and passion settlements over the life of the car loan, aiding individuals in recognizing their financial responsibilities. Furthermore, the system offers the versatility to contrast numerous car loan situations simultaneously, empowering customers to review different borrowing options effectively. Generally, these vital functions collaborate to enhance the user's lending management experience, providing a insightful and comprehensive tool for reliable economic preparation.

Adjustable Repayment Alternatives

Via the adjustable repayment alternatives, customers can trying out different situations to identify the most suitable repayment prepare for their particular demands. Whether individuals like a shorter car loan term with higher regular monthly repayments to reduce overall passion or choose a prolonged repayment routine to lower the regular monthly financial worry, the Financing Calculator System empowers users to make enlightened decisions.

Furthermore, the capacity to personalize repayment choices promotes monetary responsibility and empowerment among borrowers. By acquiring visibility right into how various payment approaches influence their overall lending terms, customers can efficiently handle their financial resources and job towards achieving their long-term financial goals.

Financial Obligation Malfunction

Understanding the break down of financial responsibilities is essential for debtors to effectively handle their settlement plans. By having a clear understanding of where their money is going, debtors can stay and make informed choices on track with their financial commitments. The monetary commitment malfunction usually consists of the primary quantity borrowed, the passion accrued over the repayment duration, any extra fees or costs, and the total payment quantity. This failure aids borrowers see just how much of each payment goes towards repaying the principal balance and just how much is assigned to rate of interest and various other expenditures.

Having an in-depth financial obligation breakdown offered see this site by an advanced financing calculator system can encourage customers to spending plan efficiently and prioritize their repayments. It permits borrowers to visualize the influence of different repayment methods, such as making added payments towards the principal or readjusting the car loan term. With this information at their fingertips, debtors can take control of their economic obligations and job in the direction of accomplishing their repayment objectives successfully.

Contrast and Tracking Capacities

In addition, tracking capacities make it possible for customers to monitor their payment progression in time. They can easily track the continuing to be equilibrium, repayment background, and general financing condition, permitting for better financial planning and management. The system's ability to generate in-depth reports and graphes of the settlement schedule more aids consumers in comprehending the influence of different circumstances on their economic wellness.

Fundamentally, the comparison and monitoring capabilities incorporated into the car loan calculator system give customers with beneficial insights and openness, facilitating responsible borrowing and effective finance management.

Final Thought

In verdict, the sophisticated funding calculator system provides numerous benefits for handling car loans effectively. home loan calculator. With customizable settlement options, in-depth economic commitment break down, and contrast and monitoring capabilities, individuals can make enlightened choices about their these details financings. This system boosts the overall funding monitoring experience by giving comprehensive tools and attributes to aid people better understand and manage their monetary responsibilities

Get In the Advanced Funding Calculator System, a sophisticated service created to raise your finance monitoring experience to brand-new elevations. One essential benefit is the system's ability to offer accurate and immediate estimations for various kinds of loans, consisting of home mortgages, vehicle loans, and individual financings. Customers can input various variables such as finance amount, rate of interest price, and lending term to promptly identify month-to-month repayments and total rate of interest over the life of the car loan. The innovative Loan Calculator System offers an array of crucial features that establish it apart in the realm of funding monitoring tools.In conclusion, the innovative finance calculator system provides numerous advantages for handling loans properly.